what is suta tax california

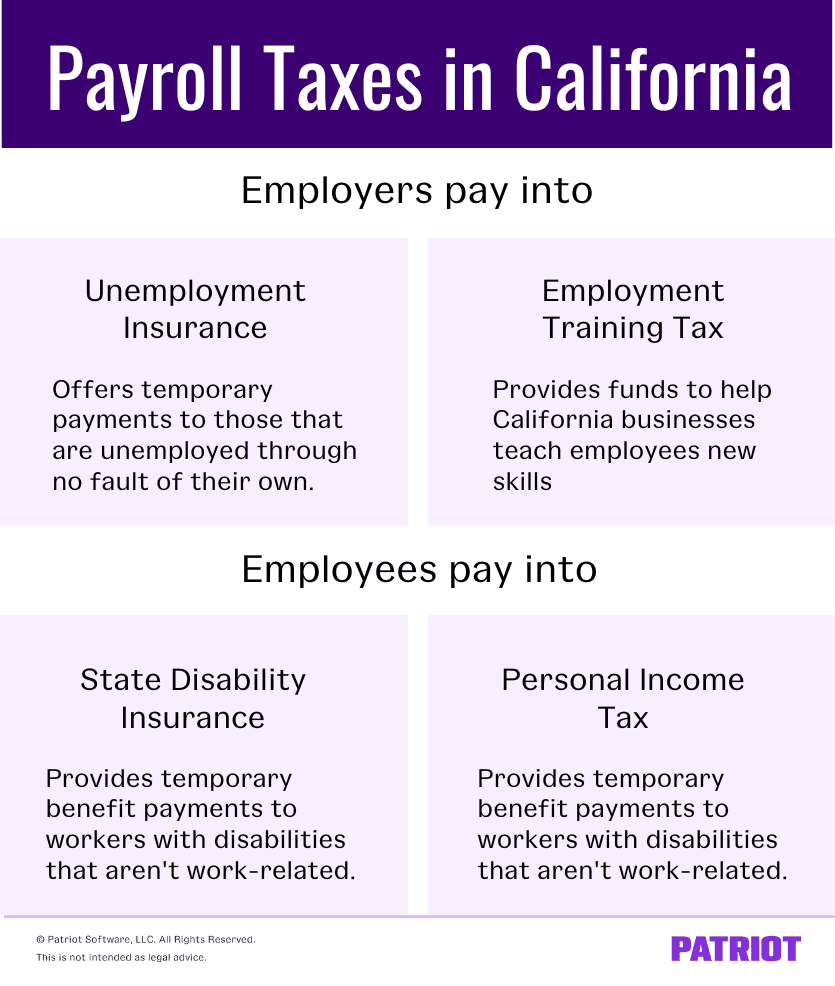

PIT is a tax on the income of California residents and on income that nonresidents get within California. See Determining Unemployment Tax Coverage.

State Unemployment Tax Act Suta Bamboohr

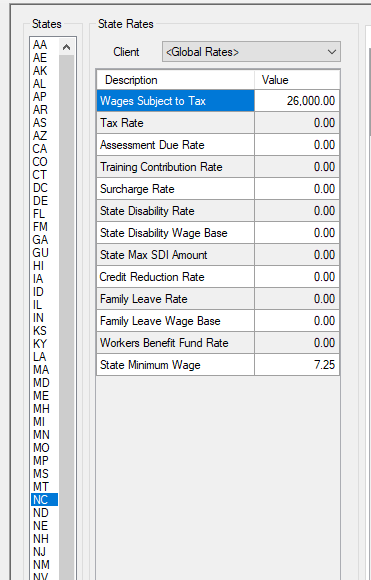

The new-employer tax rate will also remain stable at 340.

. Who pays Suta in California. California uses the Dynamex ABC Test to determine whether a worker is an employee for purposes of unemployment tax coverage. SUI tax aka SUTA tax and FUTA tax are both unemployment-related payroll taxes.

We work with the California Franchise Tax Board FTB to administer this program. Employers with a positive reserve balance or those with a new employer tax rate will also be subject to the. SUTA or the State Unemployment Tax Act is a tax that employers pay on employee wages.

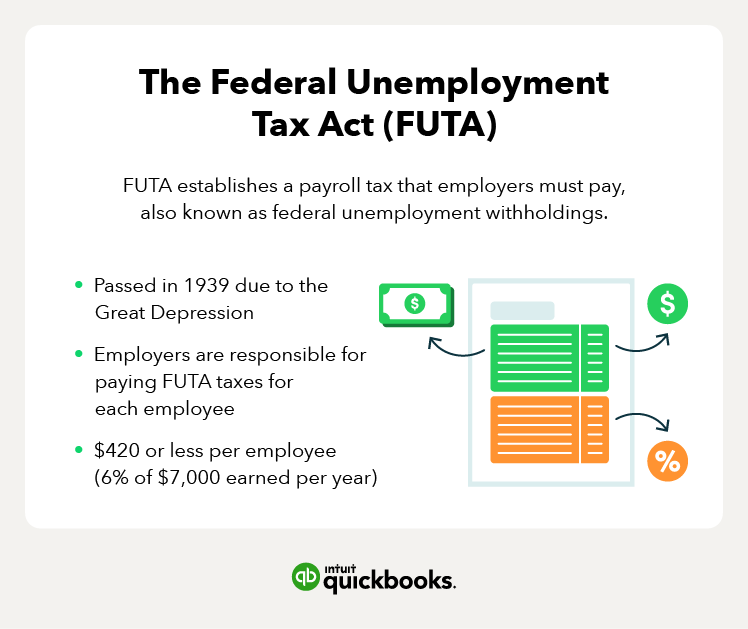

The amount of the tax is based on the employees wages and the states unemployment rate. In California for example quarterly returns for SUTA and other state payroll taxes are due on April 30th July 31st October 31st and January 31st. FUTA tax rate is 6 of the first 7000 paid to an employee annually.

2021 SUI tax rates and taxable wage base. According to the EDD the 2021 California employer SUI tax rates continue to. SUTA dumping is a tax evasion scheme where shell.

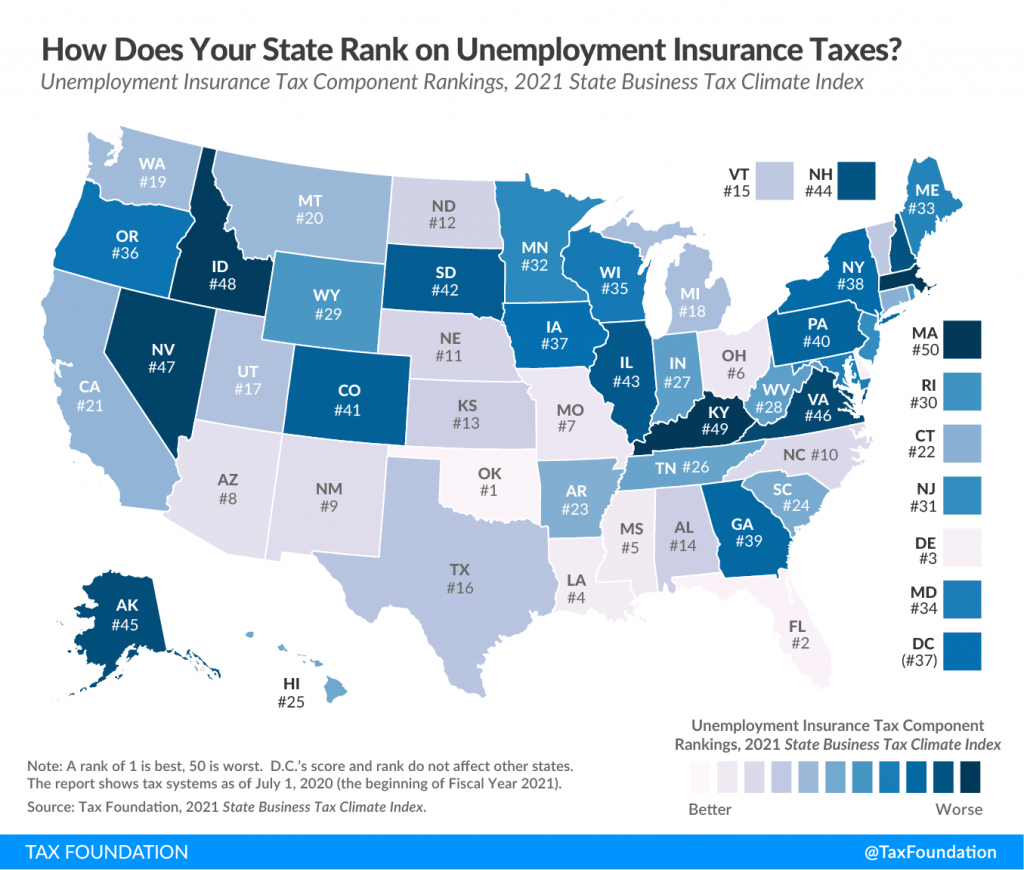

State unemployment tax is a percentage of an employees. Heres how an employer in Texas would calculate SUTA. State Unemployment Tax Act SUTA dumping is one of the biggest issues facing the Unemployment Insurance UI program.

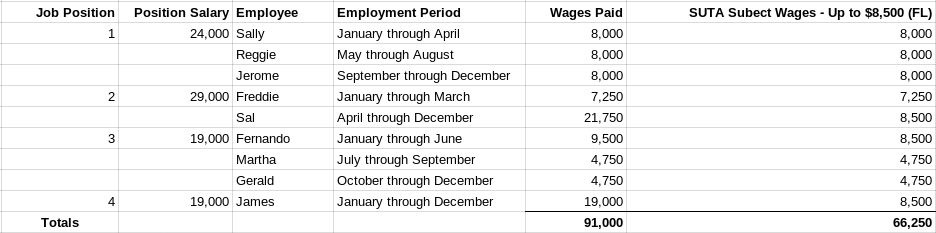

If one of your employees ever. The state unemployment tax also called the state payroll tax or simply SUTA is a payroll tax you pay into your states unemployment benefits fund. To find the SUTA amount owed multiply your companys tax rate by the taxable wage base of all your employees.

You might be interested. The SUI taxable wage base for 2021 remains at 7000 per employee. Keep in mind that earnings exceeding 7000 are not taxed and it is the employer who pays this tax and not.

The Federal Unemployment Tax Act FUTA requires that each states taxable wage base must at least equal the FUTA wage base of 7000 per employee although most.

Updating Suta And Ett Rates For California Edd In Qbo Youtube

Ezpaycheck Payroll Software Futa And Suta

Understanding Federal Payroll Tax Payments Including Futa And Suta Legalzoom

Exclusively Blown For Swank Lighting By California Artist Joe Cariati These Violet Beauties Are From The Second Edition Of Jo Lamp Glass Lamp Glass Table Lamp

What Is Sui State Unemployment Insurance Tax Ask Gusto

What Is Futa Basics And Examples Of Futa In 2022 Quickbooks

South Dakota Employers Can Take Advantage Of Online Payroll With Patriot Pay Payroll Software Payroll South Dakota

What Is Futa Understanding The Federal Unemployment Tax Act Hourly Inc

Understanding California Payroll Tax

Update Suta And Ett Tax For Quickbooks Online Candus Kampfer

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

2022 Federal Payroll Tax Rates Abacus Payroll

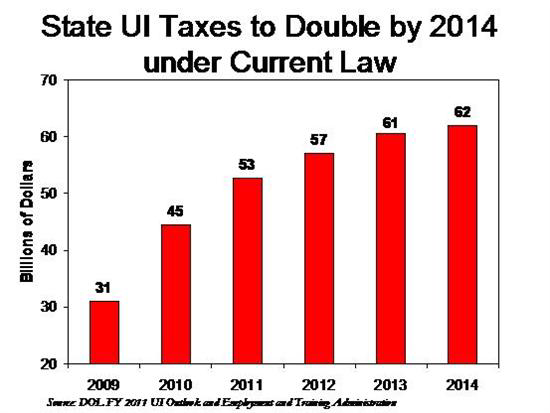

How To Reduce Your Clients Suta Tax Rate In 2014

Reducing Unemployment Insurance Costs Ui Suta

State Unemployment Tax Act Suta Bamboohr

What Is Sui State Unemployment Insurance Tax Ask Gusto

Payroll Journal Entries Journal Entries Payroll Journal

How To Calculate Payroll Taxes Futa Sui And More Surepayroll